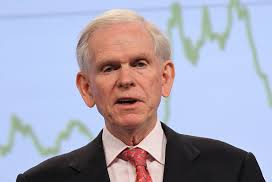

Investors know that the end is neigh for the fossil fuel industry. This perspective can be found in a shareholder letter by investor Jeremy Grantham, Co-Founder of GMO, LLC, who began his investing career as an economist at Royal Dutch Shell. He discuses the end of oil in a recent shareholder letter (Q3 2014) titled "The Beginning of the End of the Fossil Fuel Revolution" (From Golden Goose to Cooked Goose).

He explains, "As a sign of the immediacy of this problem, we have never spent more money developing new oil supplies than we did last year (nearly $700 billion) nor, despite U.S. fracking, found less – replacing in the last 12 months only 4½ months’ worth of current production! Clearly, the writing is on the wall. It is now up to our leadership and to us as individuals to read it and act accordingly."

Grantham also addresses fracking the newest member of the extraction family. He refers to fracking as "the Largest Red Herring in the History of Oil," suggesting that its economic advantages may be short-lived.

He specifically points to renewable energy as the technology that will supplant oil

"The potential for alternative energy sources, mainly solar and wind power, to completely replace coal and gas for utility generation globally is, I think, certain…That we will replace oil for land transportation with electricity or fuel cells derived indirectly from electricity is also certain, and there, perhaps, the timing question is whether this will take 20 or 40 years. To my eyes, the progress in these areas is accelerating rapidly and will surprise almost everybody, I hope including me."

He goes on to say that the rapid rise of renewables will strand fossil fuel assets. "Because of this optimism concerning the technology of alternative energy, I have felt for some time that new investments today in coal and tar sands are highly likely to become stranded assets, and everything I have seen, in the last year particularly, increases my confidence… Even when considering oil, with enough progress in alternatives and in electric vehicles one begins to wonder whether this year's $650 billion spent looking for new oil will ever get a decent return…"

He identifies the real problem that oil faces is cost. At between $75 to $85 a barrel, this represents a three fold increase from the price of oil just 15 years ago. He says that fracking, like tar sands extraction is even more labor intensive and therefore even more costly than traditional oil. These costs will only increase as we run out of the more easily accessible wells. In his view fracking will end in about three years. power,

Related

Investors in Renewables Flee Australia Causing Job Losses

Economic Benefits of Renewable Energy and Efficiency

Growth of Renewable Energy in 2015 and Beyond

One of the Best Years Ever for Renewable Energy in 2014

2014 Year End Review: Renewable Energy Achievements

Europe Moving Towards 100 percent Renewable Energy

Moving Towards 100% Renewables in the US

Asian Renewable Energy (China, India Japan, South Korea)

Home

#divest

clean

electricity

emissions free

energy

GHG

Green

greenhouse gases

less

low carbon

power

reduced

sustainable

zero emissions

Investors know that Fossil Fuels will be Replaced by Renewables (Jeremy Grantham)

- Blogger Comment

- Facebook Comment

Subscribe to:

Post Comments

(

Atom

)

0 comments:

Post a Comment