This course will take place on March 17-18, 2015 from 9 a.m. - 4:30 p.m. at Trayes Hall - Douglass Campus Center, 100 George St, New Brunswick, NJ. Help your client understand how the ecological risk assessment process aids in developing realistic approaches to remediating sites.

For LSRP's,understand the role that ecological risk assessment plays in developing clean-up goals for your site. This two-day program will provide you with a comprehensive overview of regulatory expectations of ecological risk assessments from both federal and state perspectives.

On Day One, learn about methodologies and innovative approaches being employed to conduct ecological risk evaluations and assessments of aquatic and terrestrial ecosystems under CERCLA, RCRA, and various state mandates.

On Day Two, NJDEP representatives will take you through the new NJ guidance document for the completion of ecological risk assessments under the Licensed Site Remediation Professionals Program.

Help your client understand how the ecological risk assessment process aids in developing realistic approaches to remediating sites. For LSRP's, understand the role that ecological risk assessment plays in developing clean-up goals for your site.

This two-day program will provide you with a comprehensive overview of regulatory expectations of ecological risk assessments from both federal and state perspectives.

On Day One, learn about methodologies and innovative approaches being employed to conduct ecological risk evaluations and assessments of aquatic and terrestrial ecosystems under CERCLA, RCRA, and various state mandates.

On Day Two, NJDEP representatives will take you through the new NJ guidance document for the completion of ecological risk assessments under the Licensed Site Remediation Professionals Program.

Featured Topics

Applicability of Ecological Risk Assessments

Federal, State (NJ, NY and PA) and Regional Approaches

Regulatory Drivers

Development of Clean-up Goals

Hazard Assessment: How and Why

The US EPA's 8-Step Process

And much more!

Instructors

Charles Harman, AMEC Earth and Environmental

Nancy Hamill, NJ Department of Environmental Protection (NJDEP)

Allan Motter, NJ Department of Environmental Protection (NJDEP)

Click

here to register.

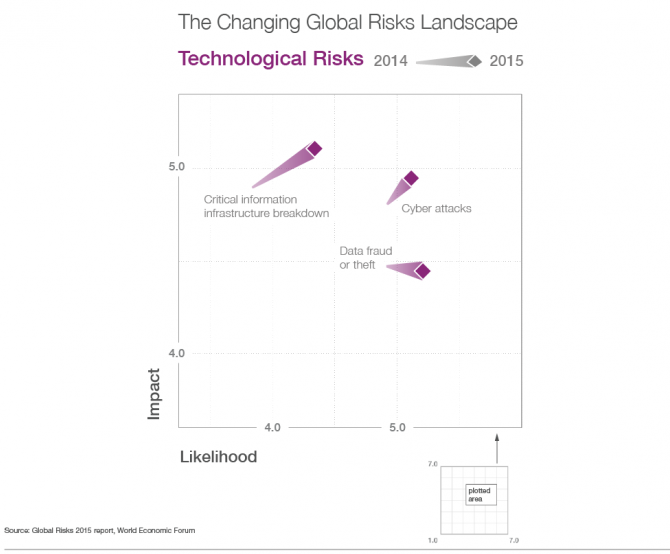

RelatedRisks Associated with Environment, Climate, Water Crisis and Extreme Weather in the WEF 2015 Report Infographic - 2015 Global Risks ReportVideo - WEF 2015 Global Risks ReportVideo - Climate Risks: Abrupt Unpredictable Irreversible Changes Video - UN Report on the Business Risks from Climate ChangeManaging Materiality, Risk and Stakeholder Engagement in Sustainability Reporting Infographic - Sustainable Business Risk Management Rise Initiative: Helping Businesses and Investors Manage the Risks Associated with Climate Change Factoring Climate Risks for BusinessSectors Most at Risk from Climate ChangeWorld Economic Forum Risk Report Singles Out Climate Change World Economic Forum Report: '"Global Risks 2014" Guide - Physical Risks from Climate Change (Ceres)Global Risks Report 2013: Interconnectedness of the Economy

.jpg)